790 Peachtree Industrial Blvd, Suite 200, Suwanee, GA 30024

CA::CALLCCALL US: (404) 495-4895

How to Prepare Your Dental Practice for an IRS Audit

Ensure Proper Preparation for Your Practice

Best Dental CPA in Suwanee, GA

For dental practice owners, financial management is just as important as providing quality patient care. One area that often causes stress is the possibility of an IRS audit. While no business owner wants to face an audit, being prepared can make the process much smoother.

At Pro-Fi 20/20 Dental CPAs in Suwanee, GA, we specialize in financial consulting and tax compliance for dentists, ensuring practices stay audit-ready. Whether you need support with bookkeeping for dentists or dental business valuations in GA, here’s how to prepare your dental practice for an IRS audit.

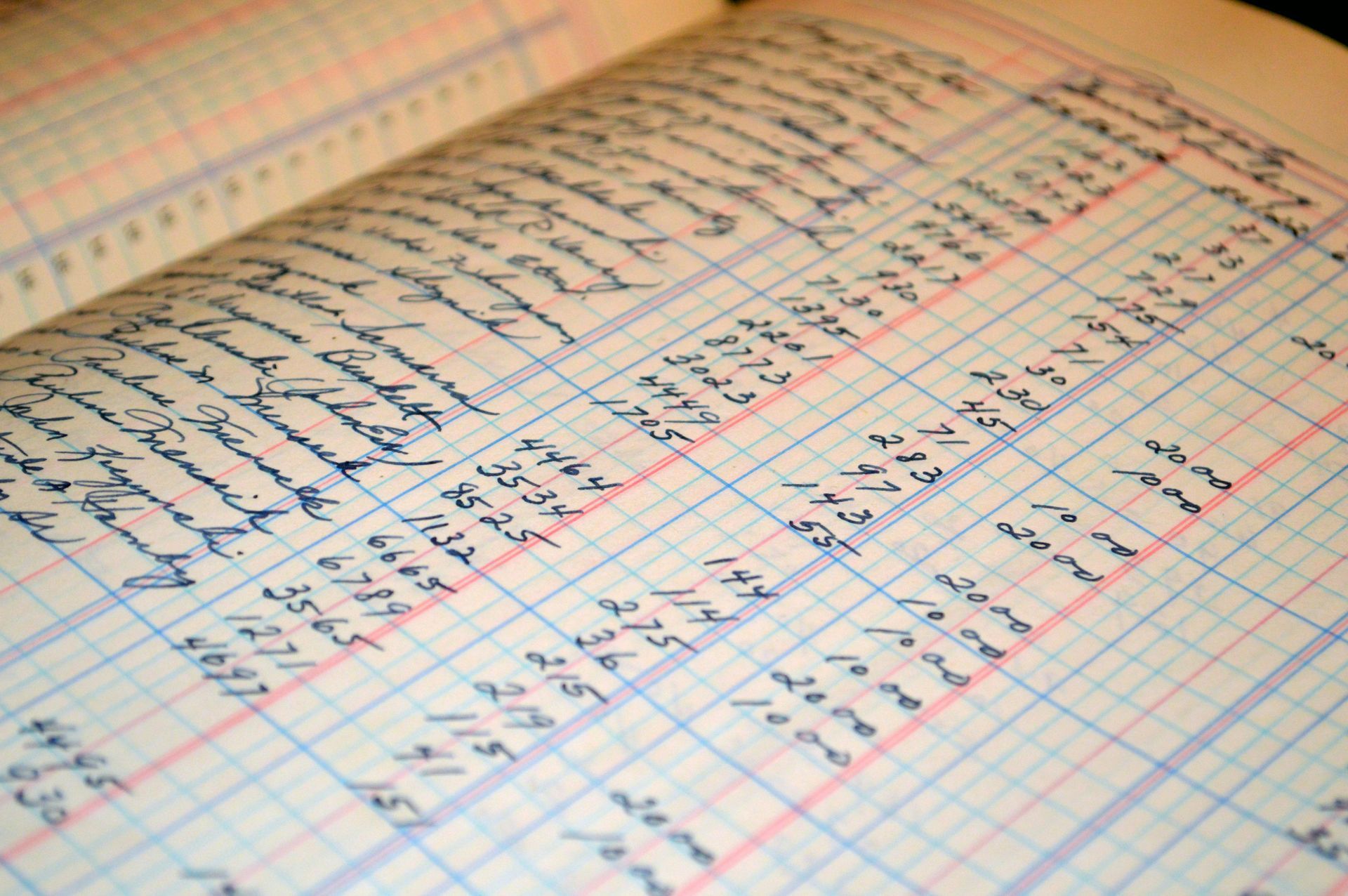

1. Maintain Accurate and Organized Financial Records

The first step to surviving an audit is having well-documented financial records. The IRS typically reviews income, expenses, payroll, and tax filings to ensure everything is accurate. Key records to maintain include:

- Financial statements, including profit and loss reports.

- Payroll and employee classification records.

- Receipts for business expenses, including equipment purchases.

- Bank statements, especially for bank loans for dental businesses in GA.

Regular bookkeeping for dentists helps prevent errors and ensures that financial records are always in order.

2. Identify Common IRS Red Flags

Certain triggers may increase the likelihood of an audit for dental practices, such as:

- Excessive Deductions: If deductions appear too high compared to industry standards, the IRS may take notice.

- Employee vs. Independent Contractor Classification: Misclassifying workers can raise red flags.

- Cash Payments and Unreported Income: Dental practices that accept large amounts of cash should ensure all transactions are properly recorded.

Working with a dental CPA can help ensure your practice remains compliant and audit-ready.

3. Understand Tax Deductions and Compliance

A common reason for audits is improper tax deductions. A CPA consulting services GA firm can help identify which deductions are allowed and ensure they are properly documented.

Some key tax-deductible expenses for dental practices include:

- Office rent and utilities.

- Equipment and technology purchases.

- Staff salaries and benefits.

- Marketing and advertising expenses.

4. Work with a Dental CPA for Ongoing Compliance

A dental CPA is essential for helping dental practices navigate audits, tax filings, and financial planning. CPA consulting services GA providers offer:

- Tax compliance and planning.

- Financial reporting to ensure tax filings are accurate.

- Support with dental business valuations GA to assess practice worth.

5. Responding to an Audit Request

If the IRS selects your dental practice for an audit:

- Gather all requested documentation.

- Work with a CPA to review and organize financial records.

- Provide only the required information to avoid unnecessary scrutiny.

By working with a trusted CPA firm like Pro-Fi 20/20 Dental CPAs, you can ensure a smooth audit process and financial stability.

790 Peachtree Industrial Blvd, Suwanee, GA

Receive a NO-COST consultation with our tax planning team!

Let our tax planning team “X-Ray” your numbers!

OFFICE HOURS

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

8:30 am - 5:00 pm

8:30 am - 5:00 pm

8:30 am - 5:00 pm

8:30 am - 5:00 pm

8:30 am - 5:00 pm

Closed

Closed

© 2025 Pro-Fi 20/20. All Rights Reserved | An Art of Dental Marketing Website | Privacy Policy